In the ever-evolving world of cryptocurrency, retail investors often find themselves caught in the crossfire of market dynamics orchestrated by insiders and venture capitalists (VCs). As the crypto landscape matures, understanding the interplay between insider wallets, VC trends, and exit liquidity becomes crucial for safeguarding your investments.

🧠 Understanding Insider Wallets and Their Influence

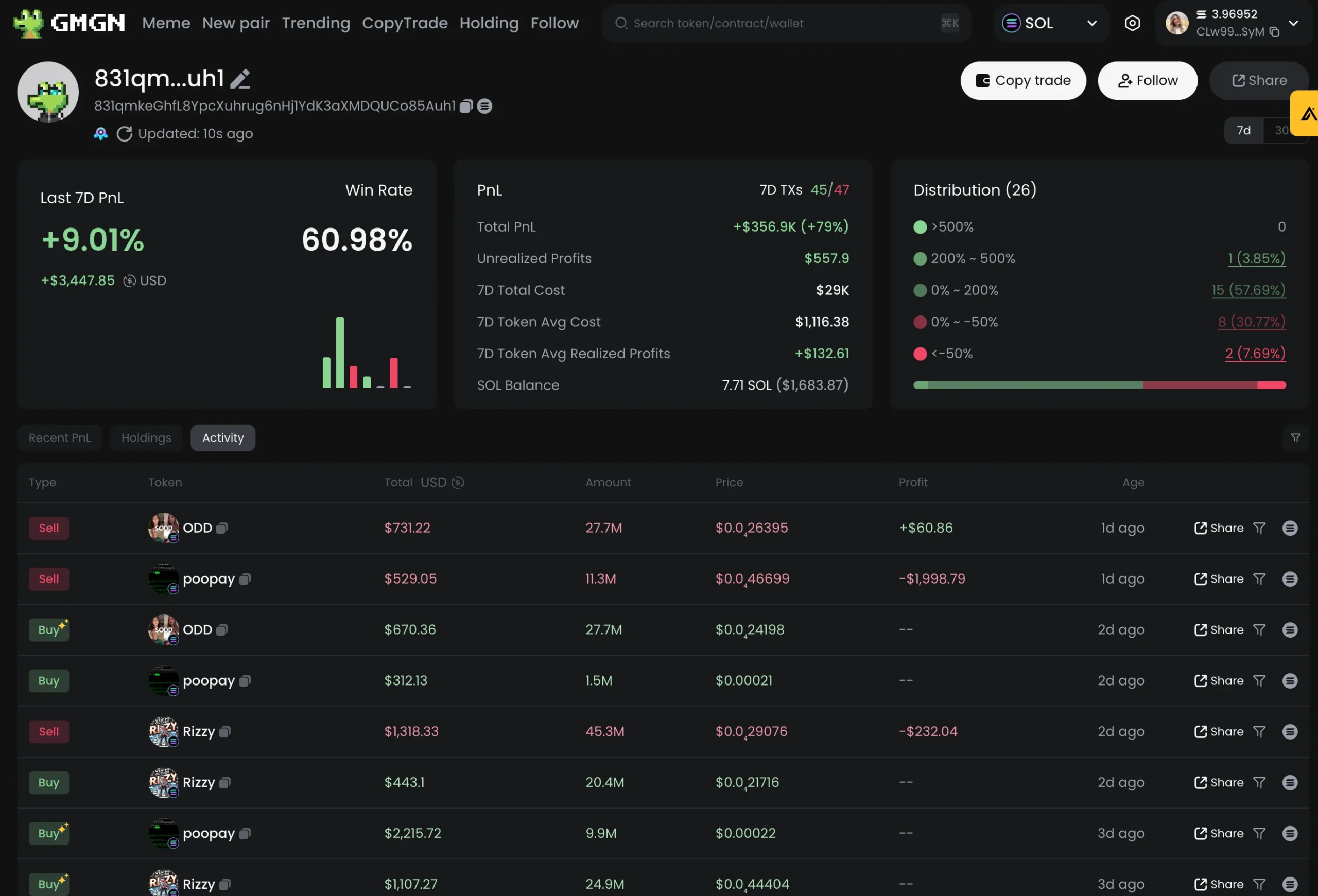

Insider wallets refer to those controlled by early investors, project founders, or affiliated entities. These wallets often hold significant amounts of a token and have the power to influence its market price. By monitoring these wallets, investors can gain insights into potential market movements. However, this practice comes with caveats:

- Misleading Profit Metrics: Some tools track wallet performance, but they may not account for factors like trading fees or external fund deposits, leading to inflated profit figures.

- High-Risk Strategies: Many insiders employ a “spray-and-pray” approach, investing in numerous tokens with the hope that a few will yield substantial returns. This strategy can be risky and may not be replicable for retail investors with limited capital.

- Potential for Losses: Even if an insider wallet shows a high win rate, it doesn’t guarantee success. Factors like market timing and liquidity can affect outcomes, making it challenging for retail investors to mirror these strategies effectively.

💼 Venture Capital Trends: A Shift in Investment Strategies

Venture capitalists have traditionally played a pivotal role in funding and supporting crypto projects. However, recent trends indicate a shift in their approach:

- Decline in Exits: VC-backed crypto exits have reached a three-year low, with only 12 recorded in Q4 2023. This decline suggests challenges in achieving profitable liquidity events for startups.

- Focus on Infrastructure: VCs are increasingly investing in infrastructure development rather than speculative projects like NFTs or metaverse ventures. This shift reflects a more cautious and long-term investment strategy.

- Token Unlock Fatigue: The prolonged bear market and declining altcoin prices have led to “token unlock fatigue,” where the release of tokens from vesting schedules fails to generate the anticipated market activity.

🚪 Exit Liquidity: The Hidden Risk for Retail Investors

Exit liquidity refers to the ability of insiders or VCs to sell their holdings without significantly impacting the market price. While centralized exchanges (CEXs) have historically served as platforms for price discovery, recent trends indicate that decentralized exchanges (DEXs) are now leading in this regard. However, CEXs continue to function as exit liquidity for insiders and VCs.

This dynamic poses a risk for retail investors:

- Price Volatility: As insiders offload their holdings on CEXs, the market price can experience sharp declines, leaving retail investors with depreciating assets.

- Market Manipulation: Coordinated selling by large holders can create artificial market movements, trapping retail investors who may not have the resources to react swiftly.

- Lack of Transparency: Retail investors may not have access to the same information as insiders, making it challenging to anticipate market shifts and protect their investments.

🔐 Protecting Yourself from Being Exit Liquidity

To mitigate the risks associated with insider activities and VC trends, consider the following strategies:

- Diversify Your Portfolio: Avoid concentrating your investments in a single asset or project. Diversification can help spread risk and reduce potential losses.

- Conduct Thorough Research: Before investing, analyze the project’s fundamentals, team, and market potential. Relying solely on wallet tracking tools can be misleading.

- Stay Informed: Keep abreast of market trends, regulatory developments, and project updates. Knowledge is a powerful tool in navigating the crypto landscape.

- Exercise Caution with New Listings: Be wary of tokens that experience rapid price increases upon listing. Such movements can indicate manipulation or pump-and-dump schemes.

- Engage with the Community: Participate in discussions on forums and social media platforms to gain insights from other investors and stay informed about potential risks.

📈 Conclusion

While the allure of quick profits in the crypto market is tempting, it’s essential to recognize the underlying dynamics that can affect your investments. By understanding the roles of insider wallets, VC trends, and exit liquidity, you can make more informed decisions and protect yourself from potential pitfalls. Remember, in the world of cryptocurrency, knowledge and caution are your best allies.

Comments are closed