Cryptocurrency has seen explosive growth over the past decade. New projects and tokens seem to pop up daily, each promising to be the next big thing. Whether it’s a meme coin or an ambitious blockchain platform, many tokens enjoy massive initial hype. But, as we’ve seen with the rise and fall of various tokens, most fail to sustain their value and vanish into obscurity. So, what happens? Why do most coins struggle to survive after the initial surge?

The answer lies in tokenomics—a term that refers to the economic model that governs how a cryptocurrency’s token operates within its ecosystem. Understanding tokenomics is key to understanding why so many coins fail and what separates those with long-term potential from those built for short-term speculation. In this article, we’ll break down the basics of tokenomics and explore why many coins crash after the hype.

What Is Tokenomics?

Tokenomics is a blend of “token” and “economics.” It’s the study of the financial structure behind a cryptocurrency, covering aspects like how tokens are distributed, how they function within the ecosystem, and the mechanisms in place to drive demand and value. Essentially, tokenomics is about the rules and incentives that govern the lifecycle of a token.

There are several key factors in tokenomics that can influence the success or failure of a coin:

- Supply and Demand: The total number of tokens and how they’re distributed can dramatically impact a token’s value. If there are too many tokens in circulation, it may lead to inflation and drive down the price.

- Utility: Does the token serve a real purpose, or is it just speculative? Coins with strong use cases or underlying technology tend to have better staying power than those that are merely “hype-driven.”

- Incentive Structures: Tokenomics should incentivize people to hold and use the token. Without proper incentives, people may dump the token once the initial hype fades.

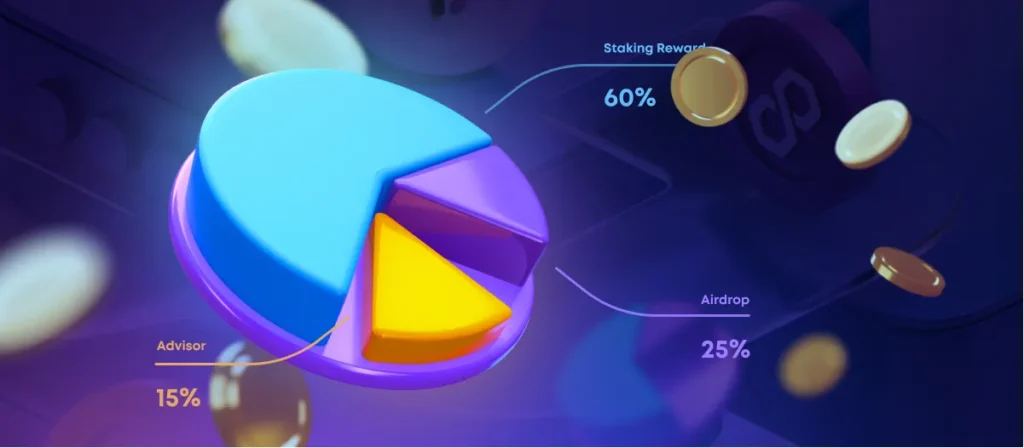

- Governance and Distribution: How tokens are distributed and who controls the network can affect a project’s long-term viability. If too many tokens are held by a small group of people (whales), it can lead to manipulation and unfair price movements.

Why Most Coins Fail After the Hype

There are a few common reasons why the majority of coins fail after their initial hype dies down. Let’s explore these in detail:

1. Overinflated Supply

One of the most critical aspects of tokenomics is the supply of tokens. If a coin has too many tokens in circulation or a total supply that keeps increasing without limit, the value of each token will likely diminish over time. This is often referred to as inflation.

Some projects have no clear mechanism for reducing supply or managing inflation. For example, Dogecoin, initially started as a meme coin, has an unlimited supply. This means that there will always be more tokens entering circulation, which can keep the price low and prevent long-term price growth. The initial hype might push the price up temporarily, but without a system to control inflation or scarcity, the token’s value will erode.

Why It Fails: Without controlling inflation, a token’s value will likely drop over time as more tokens flood the market, diluting its value.

2. Lack of Real Utility

Many tokens are created with little or no real utility—meaning they don’t serve a specific purpose or solve a problem. Some coins are created simply as a speculative asset, hoping to ride on the coattails of another successful project. However, this lack of a functional, long-term use case often leads to failure after the initial hype fades.

For example, coins like Shiba Inu and SafeMoon saw huge surges in price primarily driven by speculation and social media trends, rather than any real technological advancements or value propositions. Once the initial excitement wanes, these coins struggle to maintain their value because they don’t offer any tangible benefits outside of speculation.

Why It Fails: Tokens without a real use case or utility don’t have any reason for people to hold or use them once the hype dies down. They lack long-term value.

3. Unsustainable Hype and Speculation

Cryptocurrencies, especially new ones, often experience huge surges in value driven by speculation rather than solid fundamentals. When people hear about a new coin or token that’s gaining attention, they rush in hoping to make quick profits, only to abandon the coin once they see the price start to drop.

The initial pump-and-dump cycle is common in the crypto space, where speculators buy in during the hype phase, driving the price up, and then quickly sell when the price peaks. This can cause the price to crash, leaving late investors with worthless tokens.

Why It Fails: The speculative nature of many tokens means their value is based on emotions and market sentiment rather than actual demand or utility. Once the hype fades, the price often crashes, and the project loses credibility.

4. Poor Incentive Design

Tokenomics should include a clear structure for incentivizing people to hold, use, and support the token. This might include staking rewards, governance tokens, or other mechanisms that encourage users to engage with the project long-term.

Without a robust incentive structure, investors may dump their coins once the initial excitement wears off. For example, if a token doesn’t provide any rewards for staking or offering governance rights, users may not see the value in holding the token, leading to widespread selling.

Why It Fails: If there’s nothing to incentivize users to hold the token (like staking rewards, voting power, or exclusive access to features), they are more likely to sell and move on to something else.

5. Centralization and Control

In a decentralized network, the ideal goal is to distribute control as widely as possible. However, many crypto projects have a highly centralized control structure, where the creators or early investors own a significant portion of the tokens. This creates the potential for manipulation—where a small group of people (or even one person) can heavily influence the price or direction of the project.

When the majority of tokens are in the hands of a few, it also means that whales (large holders of the token) can sell off their holdings at any time, causing the price to plummet. Without proper distribution and governance mechanisms, the market can become prone to manipulation, and investors lose trust in the token.

Why It Fails: A highly centralized token economy often leads to market manipulation and a lack of trust from investors, who may feel their investments are vulnerable to unfair price fluctuations.

What Separates Successful Coins from the Failures?

So, what do the successful coins have in common? The ones that stand the test of time—like Bitcoin, Ethereum, and even Solana—have solid tokenomics, with well-thought-out supply models, real utility, and strong communities. Here’s what successful tokens often do differently:

- Limited and controlled supply, creating scarcity and demand.

- Strong real-world utility, whether it’s for payments, decentralized finance, or smart contracts.

- Clear incentives to encourage holding, staking, or using the token.

- Decentralized governance that gives users a voice and reduces central control.

Conclusion: The Hype Is Fun, But Tokenomics Matter

In the fast-paced world of cryptocurrency, it’s easy to get swept up in the excitement of a new token that’s experiencing massive hype. However, without strong tokenomics, most of these coins are destined to fail once the initial wave of excitement dies down. Understanding the economics behind a coin—the supply model, utility, incentives, and governance—can help you make smarter decisions as an investor or even a casual observer in the crypto space.

If you’re looking to get involved in cryptocurrency, remember that it’s not all about the next big “pump.” Look for tokens with solid tokenomics and a clear use case, and avoid getting caught up in speculation and hype. Tokenomics matter—because in the end, it’s the long-term fundamentals that determine whether a coin has staying power or is just another flash in the pan.

Comments are closed